Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Business relationship disclosure: The article has been written by Qineqt's Retail Analyst. Qineqt is not receiving compensation for it (other than from Seeking Alpha). Qineqt has no business relationship with any company whose stock is mentioned in this article.

Chipotle (CMG), a Mexican fast food chain, has been very successful over the years. The company has strong financials and is expanding at a fast pace. After a slightly lower than expected growth in revenues, still in high double digits, the stock has dropped from $440 in April to its current $300 price. This decline was aided by David Einhorn's recent short position in the stock. This correction, which is more due to the market getting ahead of itself, is an ideal time to buy CMG. The only risk to our investment thesis is if the company does not grow as fast as is warranted by its high valuations. So far, it has been growing faster than the restaurant industry.

The latest 5% drop in the stock price is attributable to hedge fund manager David Einhorn's short thesis regarding CMG, in which he states that Chipotle's business model is susceptible to competition as the barriers to entry are low. He also cited the resurgence of Taco Bell, owned by Yum Brands (YUM), as a threat that might drive customers away from Chipotle. According to David, Taco Bell's Cantina Bell menu is a direct competitor to CMG, and Taco Bell wins in pricing and convenience. Einhorn is not long on Yum Brands. CMG's spokesperson said that they do not see Taco Bell as a threat to Chipotle's sales because of the brand loyalty of its customers, who can tell the difference between what CMG and Taco Bell have to offer. Rising prices of meat and grain, along with healthcare spending on Chipotle's employees, will increase the company's expenses, according to Einhorn.

According to its Q2 2012 results, same store sales at restaurants were up 8% compared to 10% in 2Q 2011, while revenues were up 20.9% compared to 22.4% last year. Revenues were driven by new restaurants as well as existing ones. 55 new stores were added to the chain; 39 were opened in the same quarter last year, showing that expansion is faster now.

Operating margins have increased despite food cost inflation. In Q1 2012, the company had guided to mid-single digit food inflation. The table below shows some operations results in comparison to last year's results.

Q2 2012 | Q2 2011 | |

Operating margin | 29.2% | 25.8% |

Diluted earning per share | $2.56 | $1.59 |

The company has also beaten analyst estimates of EPS for both quarters this year. In Q2, the company posted $2.56/share as compared to analyst estimates of $2.3/share, though they missed revenue estimates by $14 million. The company's Q3 2012 earnings are expected to be released on October 18. Analysts expect EPS of $2.3 as compared to $1.9 in Q3 last year. The company guided to 155-165 new restaurants in 2012. With 32 restaurants opened in Q1 and 55 in Q2, 68-78 more will be opening this year.

General Restaurant Industry Outlook:

According to the National Restaurant Association, the restaurant performance index was up 0.4% due to a rise in same-store sales and customer traffic in August. Restaurant owners have been cautious about sales growth and economic conditions in the past several months, and CMG's sales growth in this scenario is impressive.

Valuations:

The mean target price for the stock is $400 and the company was trading at $440 in April. The Forward P/E for the company is 28x, but enjoys a very high growth rate of 22% (next five-year). McDonalds (MCD) has a Forward P/E of 15x and Yum Brands has a Forward P/E of 18x, with the next five-year growth rates being 9% and 14%, respectively.

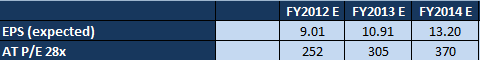

At a Forward P/E of 28x and consensus EPS estimates, the valuations come out to be:

(2014 EPS is calculated by applying 22% growth rate on 2013 expected EPS)

Although we agree that there is nothing stopping competitors from trying to imitate Chipotle due to its success in Mexican fast food, the company still has much to offer with its expansion, local and international, still under way, which will drive growth. We recommend buying CMG at the current price, however, we advise investors to be mindful of any slowdown in growth.

Source: http://seekingalpha.com/article/902671-why-is-david-einhorn-wrong-on-chipotle?source=feed

Gigi Chao Jimmy Hoffa Ed Hochuli Opie avengers soa andy williams

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.